What Is General Liability Insurance?

by Admin

Posted on 28-07-2022 07:05 PM

“what is general liability

insurance

?” this is a question many business owners ask. And they don’t just want to know what it is, they want to know if they need it. The truth is, liability insurance is an essential part of an insurance plan.

General liability insurance (gli) can help cover claims that your business caused bodily injury or property damage. This coverage is also known as commercial general liability insurance (cgl). You can get gli as a standalone policy or bundle it with other key coverages with a business owner’s policy (bop). We’re here to help you understand what insurance coverages your business may need.

General liability insurance (gli) can help cover claims that your business caused bodily injury or property damage. This coverage is also known as commercial general liability insurance (cgl). You can get gli as a standalone policy or bundle it with other key coverages with a business owner’s policy (bop). We’re here to help you understand what insurance coverages your business may need.

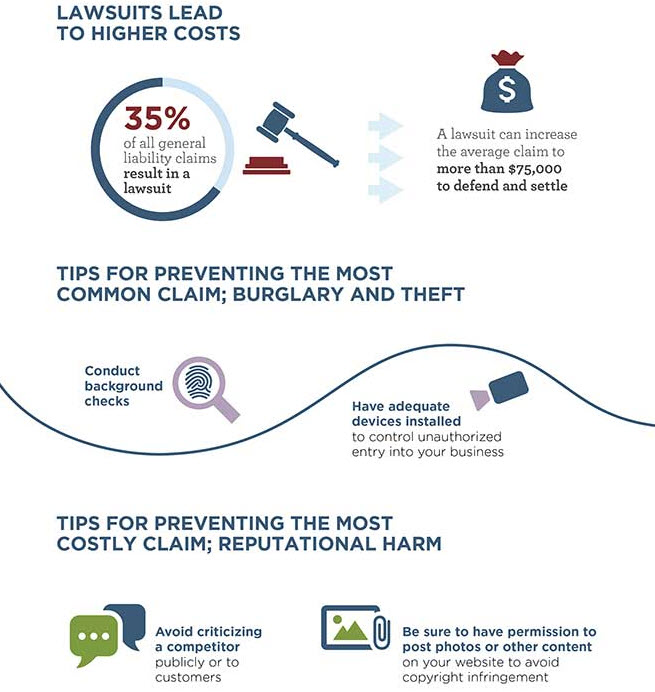

Commercial general liability (cgl) insurance provides a financial safety net in case you’re sued for an injury that occurred at your business , for damaging a visitor’s property, or causing an advertising injury , such as slander, copyright violation, or libel. Your general liability insurance will pay for reasonable costs involved in your legal defense. This includes attorney, court, and expert witness fees. It also covers any financial losses you incur while participating in your defense. General liability insurance also covers judgments and settlements related to your case, as well as the plaintiff’s medical expenses. For cases of serious property damage or injuries, settlements and court judgments can easily bankrupt a small business.

General liability insurance is often combined with property insurance in a business owners policy (bop), but it's also available to many contractors as a stand-alone coverage through the progressive advantage® business program. As a contractor or small business owner, you need some form of business liability insurance to safeguard your livelihood. A single accident could result in a lawsuit that you might not be able to handle. A great way to protect against this is to make sure you have liability coverage that matches your level of exposure. Some employers or clients might also require you to carry a certain amount of general liability before you can work for them.

Your coverage needs will depend on your type of business, location and the risks associated with such a business. Businesses are generally categorized into two broad categories; higher risk and lower risk businesses. For example, if you are a web content writer or web designer (lower risk), your business risk will definitely be lower than a roofing contractor or security firm (higher risk business). Businesses considered as higher risk businesses obviously need a lot more coverage than those considered to be lower risk. That's why you need to know what is general liability insurance. Businesses in the lower risk category may consider purchasing a business owner's policy (bop) as opposed to basic general liability insurance.

What Is Liability Insurance?

Most small companies need this insurance, especially if you rent or own an office or commercial space.

And many client contracts include requirements for general liability insurance. Even if these don’t apply to you, small businesses that work directly with clients and customers usually benefit from commercial general liability insurance, also known as a cgl

policy

. This insurance policy can keep your company financially stable if you’re sued by a customer or competitor. Because general liability insurance provides such important coverage , most small business owners buy the policy right after they start their business.

Getty there are plenty of calamities that can put a serious dent in your bottom line. For instance, your employee might spill a can of white paint on merchandise. Or a customer might get hurt after tripping on a rug in your store. Or you could be sued for reputational harm due to something you or your employee said. general liability insurance covers a small business from these types of problems (and more). It’s an essential coverage type for the best small business insurance.

If you work in the construction industry , there are certain insurance policies you must carry to protect yourself. The two forms of coverage you need to be financially protected in a building you’re working on or if your construction materials are damaged during construction are builders risk insurance and construction general liability insurance. You can purchase these policies for varying time frames, and coverage ends when the project is complete. Buy bodybuilding anabolic product, buy nutra testosterone – essah consulting magnum tren e 200 5 ampoules 200mg ml taragonne: opinion on my bodybuilding program. Contrary to popular belief, these two policies are not interchangeable.

Most businesses have general liability insurance because accidents happen. They happen even more the bigger your company is. Say, for instance, that you had a meeting with some clients and someone tripped over a handbag on the floor that belonged to one of your employees. If they got hurt, you'd be protected with this type of coverage. If you own a yoga studio, you certainly need this coverage in case a student gets hurt in class. In fact, it would be up to you, as the owner, whether or not you require that your yoga instructors carry their own general liability insurance too.

What Does General Liability Insurance Cover?

While you're busy starting and growing your own business, general liability insurance can help you protect it. If someone claims that your business caused them harm or loss and they take legal action against you, that action can cost your business plenty in defense costs and payments for damages. Having a general liability policy in place can mean the difference between keeping the doors open or going out of business when you face unforeseen circumstances. Here's what you need to know about this important coverage.

Also known as business liability insurance , general liability insurance protects you and your business from “general” claims involving bodily injuries and property damage. Almost every business has a need for general liability insurance.

What would happen to your small business if a customer slipped on the floor and injured themselves, or an on-site mishap ruined your client’s property? chances are you’d be sued for damages. Without sufficient revenue or savings, you’d be on the hook for up to millions of dollars in compensation — unless your business is protected by general liability insurance. Commercial general liability insurance protects your small business from liability for covered claims of damage to a third party’s property and harm to a third party’s body or reputation. Though it’s one of the more basic forms of business insurance, general liability (gl) insurance is often required by state law, industry regulations, or the customers and clients you work with.